When you accrue revenue, the costs are recognized as expense by using cost accruals.

You determine whether you account raw or burdened cost as the cost WIP. With cost accruals, you initially account for the costs incurred as an asset in a cost work in process (WIP) account. For these companies, cost accruals are required. Other companies use a method that recognizes revenue in future periods after cost is accrued. For such companies, cost accruals are not needed. This type of accounting is typically done with work based or time and materials revenue accrual. Some companies recognize revenue in the same period as costs. The answer depends on the revenue accrual methods that your company uses. You must determine if your company uses cost accruals during revenue generation. You must determine your accounting procedures and setup to ensure that you match expenses to revenue. Consequently, it is possible to account for expenses (costs) and revenue in different accounting periods. In Oracle Projects, cost distribution and revenue generation are two separate processes. To conform to the matching principle, you must defer expenses until revenue is accrued. Matching Principle states that all expenses must be matched and recorded with their respective revenues in the period that they were incurred instead of when. If the current period expenses are accrued immediately, but related revenues are accrued in a future period, then the profitability of the company is reduced for the current period.

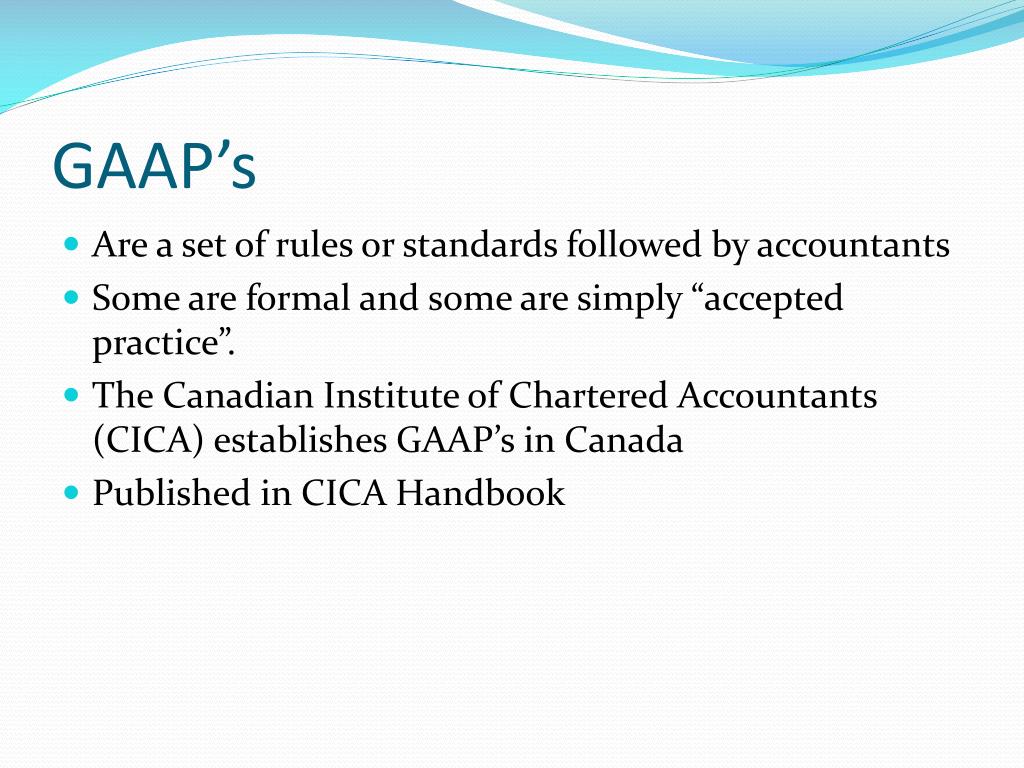

If you do not follow this matching principle, the financial statement and the reported profitability of the company are affected. The matching principle states that you must report an expense on your income statement in the period the related revenues were generated. And, the matching principle is the driving force of accrual accounting. Cost accruals are also referred to as Cost of Goods Sold or Cost of Sales.Īccording to the matching principle required by Generally Accepted Accounting Principles (GAAP), expenses (cost) incurred in earning revenue must be accrued in the same accounting period as the revenue. The matching principle (also known as the expense recognition principle) is one of the ten Generally Accepted Accounting Principles (GAAP). Revenue-Based Cost Accrual (Oracle Projects Help)Ĭost accruals are the accounting transactions to account for expenses in the same accounting period in which revenue is generated.

0 kommentar(er)

0 kommentar(er)